Does PayPal Report To IRS On Friends And Family ZenLedger

Web Mar 27 2023 nbsp 0183 32 If you re wondering does PayPal send 1099 K for Friends and Family transactions the answer is no The IRS and PayPal have specific guidelines for when this tax form is issued and it only applies to sales of goods or services not personal payments

Use Caution When Paying Or Receiving Payments From Friends Or Family , Web Mar 8 2022 nbsp 0183 32 On sites like PayPal and Venmo a payment can be designated whether it is to family and friends or a business transaction for goods and services This designation will determine if the transaction s result in the issuance of a Form 1099 K

![]()

Does PayPal Report To The IRS On Friends And Family Ledgible

Web Sep 21 2022 nbsp 0183 32 The short answer is no PayPal does not report these types of transactions to the IRS However that doesn t mean that you shouldn t report them yourself Here s what you need to know about reporting Friends and Family transactions on your taxes

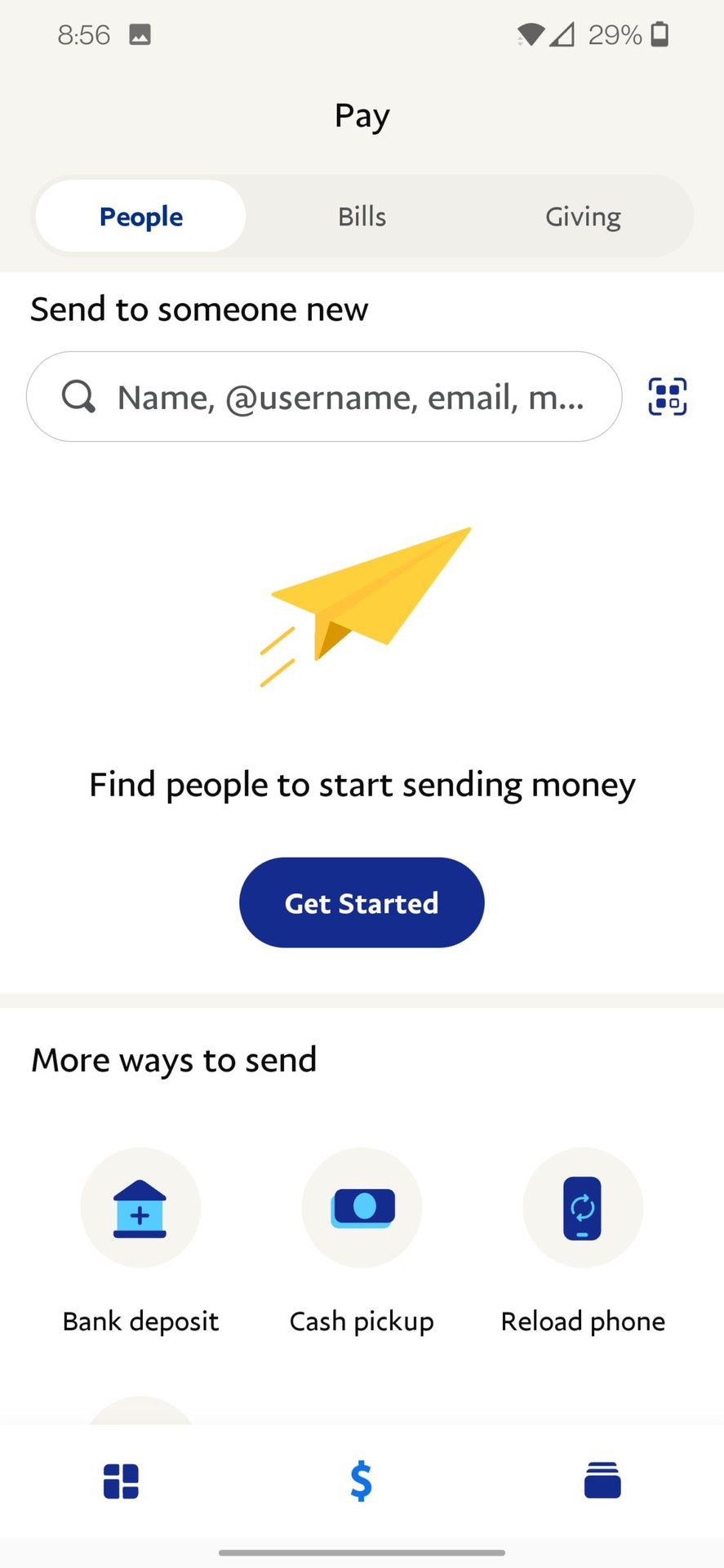

What s The Difference Between Friends And Family Or Goods And PayPal, Web Personal Payments Choose Sending to a friend for the everyday exchange of money between you and your friends and family You can use personal payments when you send money as a gift split a lunch bill pay your share of living expenses or something similar Personal payments aren t covered by PayPal Purchase Protection Fees

Tax Implications Of PayPal Friends And Family Ledgible

Tax Implications Of PayPal Friends And Family Ledgible, Web Jul 18 2022 nbsp 0183 32 Just because you re making a payment through PayPal s friends and family feature doesn t mean it can t be deducted on your taxes If the payment is for business purposes you may be able to deduct it as a business expense For example let s say you run a small online business and use PayPal friends and family to pay your web designer

Free Clipart Animated Tax Collector

Will PayPal Report My Sales To The IRS PayPal US

Will PayPal Report My Sales To The IRS PayPal US Web This new Threshold Change is only for payments received for goods and services transactions so this doesn t include things like paying your family or friends back using PayPal for dinner gifts shared trips etc

How To Send Money Through PayPal Android Authority

Web Jun 01 2019 11 20 AM Hello I just want to know if I will be required to pay tax from money received via the friends and family option I have a personal paypal account and only use my account to receive money from people I know friends and family option so I just want to know what the rules regarding taxes are Tax From Money Received Via friends And Family PayPal Community. Web Nov 16 2022 nbsp 0183 32 When preparing to send money to friends or family PayPal asks the user to choose the purpose of the transaction either Sending to a friend or Paying for an item or service and the selection made determines whether the PayPal F amp F option is used or not Web Jan 24 2022 nbsp 0183 32 If you are a small business owner it s important to remember that it s against PayPal s terms of service to request that customers pay you using the friends and family option to avoid

Another Do I Pay Taxes On Paypal Friends And Family you can download

You can find and download another posts related to Do I Pay Taxes On Paypal Friends And Family by clicking link below

- How To Send Money On PayPal Without Fees AnsonAlex

- PayPal Taxes And 1099s How They Work How To Avoid Them

- How To Add My Bank Account To Google Adsense X C Minh Google Adsense

- CBE Torx Stabilizer Single Mount Archery Talk Forum

- How To Use PayPal Friends And Family and How Not To Use It ZipBooks

Thankyou for visiting and read this post about Do I Pay Taxes On Paypal Friends And Family