Claim Mileage Greater Than 5 000km ATO Community

Jul 25 2023 nbsp 0183 32 The ATO guidelines suggests that can claim up to 5 000km You can claim a maximum of 5 000 work related kilometres per car What is the tax treatment for the greater than 5 000km

Is Mileage Allowance Taxable ATO Community, Jul 15 2024 nbsp 0183 32 I m paid for using my car to travel to various work sites not the office at both the ATO per km rate of 88c and also an additional 10c above this rate It appears the above the rate component is being taxed each pay cycle but the agreed ATO rate component is not however both components come up under my taxable income on my income statement for the year I

![]()

Motor Vehicle Mileage Cents Per Kilometer Reimbuursement

Mar 2 2021 nbsp 0183 32 Hi just wondering whether someone could clarify as to whether GST applies to the reimbursements calculated using the cents per kilometer mileage method based on the actual business kilometers travelled

RE Cents Per KM Exempt Component 2025 2026 ATO Community, Jul 14 2025 nbsp 0183 32 Hiya TinaJ I m confused are you the employer In which case you follow the ATO guidance I don t know why you would reference a state payroll tax matter that has nothing to do with PAYG withholding to vary the withholding to nil on the part of the rate that doesn t exceed the ATO reasonable rate For the current FY 2025 2026 any c km allowances you

Does A Cents Per KM Reimbursement Have Deductable GST Within It

Does A Cents Per KM Reimbursement Have Deductable GST Within It , May 2 2023 nbsp 0183 32 If an employee makes a reimbursement request for mileage using the cents per kilometre method and the total reimbursement request is for 143 52 do we break this into 130 47 pre GST 13 05 GST 143 52 total Or is the amount a GST free expense on our end

![]()

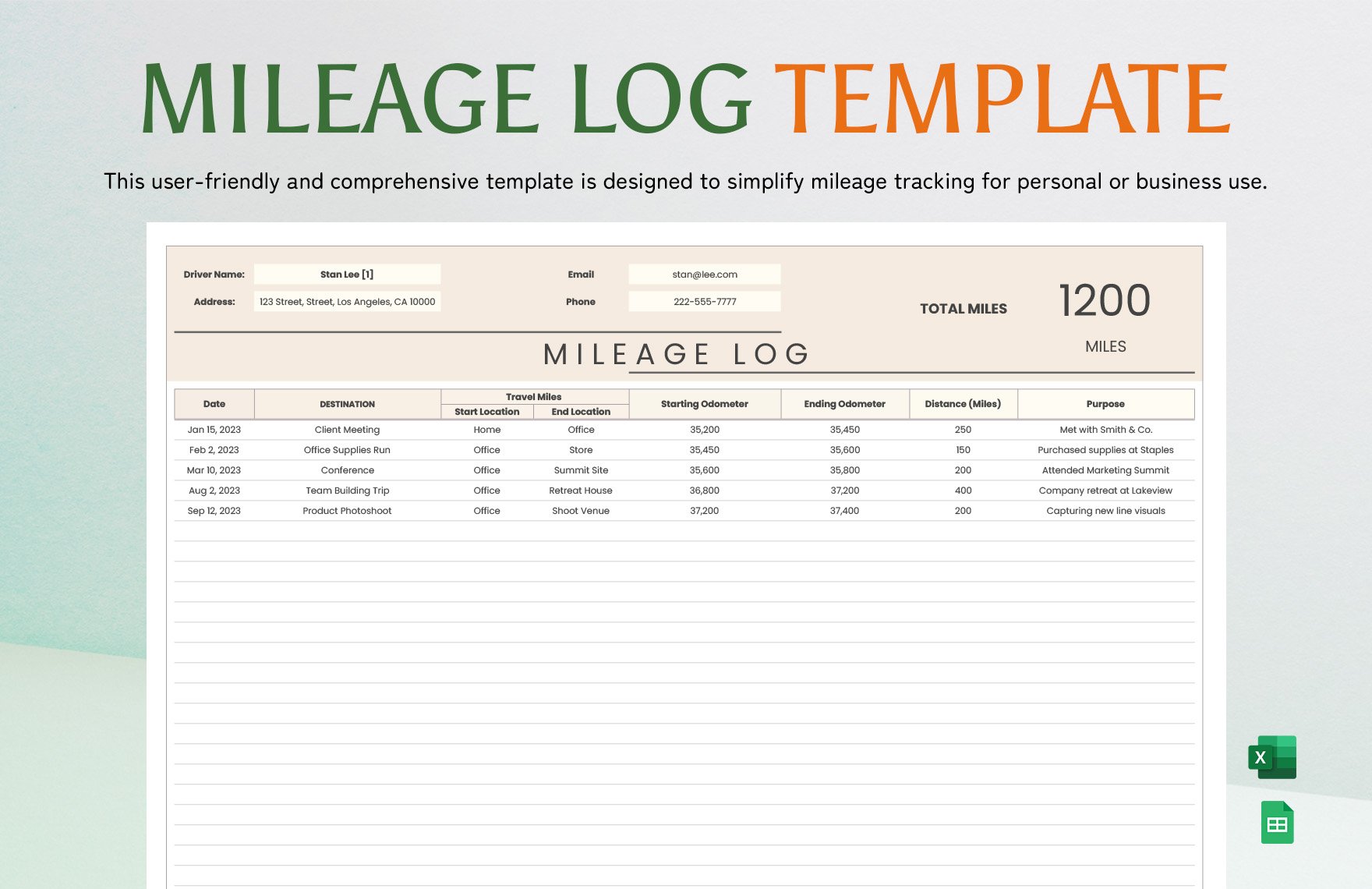

Free Employee Mileage Tracker Template Download In Excel Google

Employer Reimbuse Employee Car Expenses During Cents Per

Employer Reimbuse Employee Car Expenses During Cents Per Feb 2 2022 nbsp 0183 32 Hi my employer reimburse employees work related car expenses during cents per kilometer method The current rate for 2021 2022 is 72 cents per km according to ATO however our industry award lists 85 cents per km for motor vehicle allowance If we use 85 cents per km do we have to list this on employees payslips because it s an allowance And employees have

![]()

Excel Mileage Log Template

Jul 23 2021 nbsp 0183 32 Previously I used logbook method for vehicle and claimed appropriate percentage for GST Thinking of using cents km Can I still claim same percentage of GST for vehicle Can You Still Claim GST For Car When Using Cents km. Nov 11 2021 nbsp 0183 32 We pay our employee 80cents Per KM for any business travel using their own car paid via payroll fortnightly is this mileage payment taxable income should we withhold income tax for this payment If it s taxable income then can employee to claim business related mileage deductions in cents per kilometer method Apr 28 2021 nbsp 0183 32 The information provided by the ATO in this thread and labelled as ATO Certified was 15 months out of date at the time of the ATO post and is incorrect misleading Refer to GSTR2006 4 for cents per km the GST to claim is on a reasonable estimate of the business portion per tax period

Another Mileage Tracker Template Excel Templates you can download

You can find and download another posts related to Mileage Tracker Template Excel Templates by clicking link below

- Free Employee Mileage Tracker Template Google Sheets Excel

- Excel Tracker Templates

- Excel Mileage Log Template

- Excel Mileage Log Template

- Excel Mileage Log Template

Thankyou for visiting and read this post about Mileage Tracker Template Excel Templates